Your credit score is “YOUR CREDIT SCORE” For better or worse this is your RISK grade. Whether you buy a home or not please take the time to understand the credit game. We all play the game but most people don’t really understand the rules.

* Who Are They? Transunion, Experian and Equifax are the three largest and are generally used to hold your credit profile. They are either privatly or publicly held corporations. They make a profit from selling your information!

* Who Makes The Score? There are many credit models. Be careful, even though you may get a credit report for free you will most likley have to pay or sign up for a free trial period if you want your score. The score you get may not even be the score that the Lender will use even when it’s from one of the big three because they have their own models and the scores can vary as much as 100 points from FICO. Lenders use the FICO score.

* Who Is FICO? Fair Isaac Corporation.

* How Is My Score Calculated? Fair or not, Fair Isaac (now known as FICO) has a lot to say about whether you get a loan. A leading developer of credit scoring systems, the firm offers statistics-based predictive tools for the consumer credit industry. The FICO Score is a three-digit number based on a complex set of factors to determine a borrower’s creditworthiness. The formula used to calculate a FICO score is a closely guarded secret and has been reported to vary dynamically depending on such factors as the rate of bankruptcy filings, foreclosures and current financial climate. Here is what FICO will tell us in a booklet you can download for free. “My FICO Booklet”

If you would like to purchase the same report Lenders use or other FICO products: (inquiry will not impact FICO Score) “FICO Credit Report”

You are entitled to a free credit report but it will not show scores. Some sites you will see advertized want you to think they are the FREE credit report. Here is the link to the real site. “Official FREE Site”

If you are interested in pusuing a mortgage in Pennsylvania Norstar will pull a tri-merged report with scores at no charge to review with you. No catch! We just ask that you give Norstar a chance to compete for your business.

* What’s a Good Score? Scores run from 300-850. 720 plus is considered a good score in today’s market. Below 680 your options may become limited. Below 660-640 it can become very difficult and with scores below 620 very expensive or impossible.

* My Spouse has Good Credit but Mine is Bad? Each person gets their own 3 scores. Lenders will use the lowest middle score. (Buyer 780, 770, 749 = 770 Co-Buyer 680, 650, 638 = 650 Lender will use 650)

* How Much Can A Score Matter? Alot! About 1% in your rate from a 760 to a 659! Below is a rough guide of what a credit score may cost you on a Conforming Loan.

| 760 – 850 | Congratulations you get the lowest rate |

| 700 – 759 | .125 to .250 higher than lowest rate |

| 680 – 699 | .250 to .375 higher than lowest rate |

| 660 – 679 | .375 to .750 higher than lowest rate |

| 640 – 659 | .750 to 1.250 higher than lowest rate |

| 620 – 639 | 1.250 to 2.000 higher than lowest rate |

* 798 Credit Score … Mortgage DECLINED!Your credit score is derived from your credit profile. In addition to your score the Lender and others may look at your specific profile and decline your loan based on the information included; Too few trade lines, Authorized User Accounts, Judgements or Collections, Mortgage lates, Length of credit, as well as other factors. Just because your score meets the guidelines does not guarantee an approval.

For example you have a 798 score. Apply for a 10% down conforming loan, No derogatory credit. Paid off you old car lease and obtained a new lease 10 months ago. You have 2 credit cards, 1 you have not used in over a year and the other you pay off monthly.

In this case you would most likely be approved from the automated computer underwriting, Approved by the Lender and DECLINED for PMI (private mortgage insurance) for insufficient credit. Your options may be 20% down, 80/10/10 or FHA. So to make it a little more confusing you need to understand how your profile effects the score but also how the Lenders will view your profile. A simple thing like closing a credit card could improve your score, it could also reduce your score and it could reduce your financing options even if your score improves because your profile changed!!

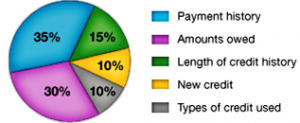

What Should a Profile Look Like? Credit established for a minimum of 2 years. At least 4 open and active trade lines (accounts). This is the tricky part, some Lenders and PMI companys will in addition want the trade lines to be “SEASONED” (open) for at least 1 year. Credit balance to credit limit at no more than 50%, 25% is even better. Payments on-time (late payments for sure hurt you but just paying ontime is only about 35% of your score). You can absolutely do it on your own, that said, there is no substitute for  experience. We have seen thousands of Credit Reports and have some inside strategies to enhance your profile and scores in the shortest time possible! Here is a breakdown of how FICO views and grades your profile. (it’s what FICO says but we all know the actual grading is a secret).

experience. We have seen thousands of Credit Reports and have some inside strategies to enhance your profile and scores in the shortest time possible! Here is a breakdown of how FICO views and grades your profile. (it’s what FICO says but we all know the actual grading is a secret).

How Long will the Items Remain on My Report? Bankruptcy: Chapter 13 remains for seven years from the date filed. Accounts included in bankruptcy will remain for seven years from the inclusion date reported as part of the bankruptcy. Chapters 7, 11, and 12 remain for ten years from the date filed.

Judgments: Remain seven years from the filing date of the judgment.

Federal, State and County tax liens: Unpaid tax liens remain fifteen years from the date filed. Paid tax liens remain seven years from the date the lien was paid.

Collection/Charge-off accounts: Remain seven years from the initial missed payment, (original delinquency date that led to the collection, even if payments are later made on the charged-off account).

Late Payments: Can remain seven years from the date of the initial missed payment.

Closed accounts: Closed accounts are accounts that are not available for use. Closed accounts may or may not have a zero balance. Closed accounts with delinquencies remain seven years from the date they are reported closed, whether closed by the creditor or by the consumer, the delinquencies will be removed pertaining to late payments seven years after the delinquency occurred. Positive closed accounts remain ten years from the date closed.

Lost credit card: If there are no delinquencies, credit cards that are reported lost will continue to be listed for two years from the date the card is reported lost. Delinquent payments that occurred before the card was lost are reported for seven years.

Inquiries: Most inquiries listed on your credit report will remain for two years. Employment or pre-approved offers of credit will only show on a personal credit report pulled by you.

How can I improve My Score? This is a great booklet created by Credit Unlimited that will help you understand how credit really works. It also contains information that will help you maximize your score! Follow the links and we will tell you how to get it for FREE. “Credit Tune-Up Booklet”

works. It also contains information that will help you maximize your score! Follow the links and we will tell you how to get it for FREE. “Credit Tune-Up Booklet”

LIFE HAPPENS… if unfortunate life circumstances have happened to you please checkout the Credit Enhancement section located under “Credit Repair” on this site.

This next section will help refine your budget. Let’s breakdown the closing costs and see why PA is so expensive, See who we need to pay and where to save some cash!

Great Info! Every once in a while I find something interesting…

I’m not sure I agree with everything you have covered in your post, but appreciate your point of view.

Hi! Really interesting article. Thanks. Best regards, Farmerama.