With foreclosures and short sales being such a large part of current Real Estate inventory here in Pennsylvania it’s important for potential Buyers and Sellers to understand what they are and how they differ.

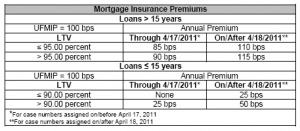

What is a Short Sale? Jack and Jill bought a house on the hill and their value came tumbling down. They now owe more on their home than the current value. Jack and Jill decided to sell and after meeting with a Realtor realized that they would need an additional $30,000 to clear title so the home could be sold. They do not have the money. The Realtor suggested a short sale that would work like this; List the home and when an agreement of sale comes in that Jack and Jill accept, it would then be sent to the mortgagee (lender/s) to see if they would agree to accept a less than full payoff. Basically if they would forgive Jack and Jill $30,000 and be short on the sale! Short Sales generally take longer to get the lender approval and it may delay you several months, so a good Realtor is essential to avoid a huge waste of time. Remember that a debt forgiven may be income to the IRS and/or the lender can place a deficiency judgement meaning they accept the sale but still want their $30,000. Current rules may allow a bypass on both, sort of a get out of jail free card. Jack and Jill need to make sure they get the terms in writing prior to! After a short sale you will be eligible for most new financing:

- Two Years= 80% Max LTV, 90% LTV Extenuating Circumstance

- Four Years= 90% Max LTV

- Seven Years= LTV per Eligibility Matrix

What is a Foreclosure? There are 3 basic documents that we will look at here. 1. Deed/Title is who owns the property. 2. The Mortgage is signed by all owners of the home accepting the lien on the property used as collateral. 3. The Note is what we commonly think of as the mortgage but is really like a big IOU for the money borrowed. When you fail to meet the terms of the Note the lender can then use the Mortgage to gain Title to the property in the process called Foreclosure. You can’t sell it till you own it! The foreclosure process in PA is handled by the Sheriff’s Department so they are considered a “Sheriff Sale” along with other types of sales such as delinquent taxes, etc. Same as a short sale you can be hit with IRS income and/or deficiency judgements so negotiate before the foreclosure happens. Once foreclosed the properties usually come on the market as HUD homes (FHA), HomePath (FNMA), REO (real estate owned, Bank) and several others. Most are listed in the MLS and a good Realtor should be able to get you access to those that are not listed as well.

A foreclosure will most times be a minimum of a 7 year waiting period for new financing. Extenuating circumstance is now 3 years = 90% LTV.

What is Deed in Lieu? Jack and Jill may elect to voluntarily hand over or surrender the title in lieu of the foreclosure process. This saves the lender time and money so Jack and Jill might be able to cut a little better deal with the lender. Same eligibility and other rules as short sale.

more info: https://pafhamortgage.com/real-estate/foreclosure-short-sale/

Disclaimer: This is meant as generally information and legal counsel is recommended if you are considering any of these actions in order to protect yourself. Information from FNMA seller Guide 3/31/2011.

By Bill Frantz at PaFhaMortgage.com