Congratulations!! You have done your homework and decided that home ownership is right for you. Many preparing buyers get anxious, frustrated, confused and possibly derailed by the whole mortgage approval and how much a Lender will qualify them for. Even worse many buyers are mislead into a loan that pre-approves them for a payment much higher than their comfort range or programs that lower the payment but needlessly increase the risk of future default! Let’s change MORTGAGE APPROVAL to PERSONAL RISK ASSESMENT to more accurately define the true goal in the process. As a buyer I’m concerned with the risk that my payment will be too high, home values may drop, I’ll be house poor, I don’t have enough reserves, I could lose my job and if something goes wrong I will lose it all. All of these risks should be concerns of the Lender as well but many times lenders do not always explain the negatives of a product. Lenders invest money and are concerned with you paying them back. Lenders are not investing in real estate, if they were, they would simply buy the home and rent it to you. Consider talking with at least one licensed local mortgage Broker to compare products available from many lenders as well as your Bank or any online offers to make sure you are getting the best rates and programs and reducing your risk!

RISK MANAGEMENT: Risk is just a fact of life. If I jump out of a plane there is risk. If the plane is on the ground I have minimal risk. Jumping out at 5,000 feet my risk of death is great, but if I use a parachute I can greatly reduce my risk. Buying life insurance does not reduce my risk of death but it will replace the loss of wages that others may depend on, greatly reducing their risk of financial hardship. Knowledge, education, training and experience can all reduce risk.

If I came to you in 2005 and wanted you to invest everything in gold at $444.74 per ounce knowing the high was $615.00 in 1980 would you borrow money to invest? What if you knew the price would be over $1,500 per ounce just 6 years later?

If you had a choice between twenty pounds of gold or a parachute and you must immediately get out of the plane, which would you choose? What are the conditions of the terms of this offer? You are at 5,000 feet and the plane is going down, which do you choose? The plane has boarded but not yet left the gate, which do you choose? The offer is the same, the answer may vary as a matter of the terms or conditions. The same is true of a mortgage, unless you understand the terms and conditions of your mortgage you may not have full disclosure and be able to make an informed decision.

The point is that risk is personal and the correct decision on payment and terms for you, is best made by you, based on the most reliable and complete information available.

TERMS MATTER: Lenders base their decision on your PITI Payment not a set loan amount! Most Mortgages are based on simple interest, it is the terms that vary! Consider ways to reduce your PITI payment that reduce payments with little or no increase in Risk!

PRINCIPAL: This is the portion that repays the loan (Buying Equity). The difference between a 30 year term and a 15 year term is the amount of minimum principal obligation per month. You can pay extra as a prepayment and reduce the unpaid balance. Consider a 30 over a 15 to buy more house.

INTEREST: A mortgage is a series of payments. The interest is calculated by multiplying the unpaid balance, times interest rate, then divide by 12 to get the interest portion due that month. A lower interest rate will lower your obligation and also accelerate principal reduction! Consider a Hybrid ARM with a risk appropriate fixed portion or points to lower rate.

TAXES: Taxes are the taxes. You can consider an area with lower taxes to reduce the payment and qualify for more house.

INSURANCE: You can shop for home insurance. Reducing the cost of your home insurance by $25 per month will buy about $5,000 more house

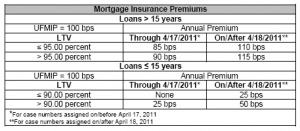

MORTGAGE INSURANCE:PMI or MIP are generally required with less than 20% down. Mortgage insurance protects the lender if you default and can be very expensive. Consider a single MI or a split loan to reduce or avoid monthly mortgage insurance if possible!

ASSOCIATION FEES: Condo and HOA fees are added to the PITI payment for qualifying and are generally overlooked by buyers. A $250 dollar a month condo fee will cost you almost $50,000 in purchase power. Consider if the association is really a benefit to you and avoid where possible.

CREDIT SCORE: Your score may greatly impact the PITI. It can affect your interest rate, closing cost, increased mortgage insurance and reduce the programs available changing the terms offered to you! Consider a rapid re-score or other techniques to improve your score. The pricing difference with <25% down and a credit score of 679 vs. 720 is about 1.5% price hit. On a $200,000 loan that is $3,000 or a Rate increase of .25% to .375% costing $40 per month and losing about $8,000 purchase power with rates around 4.5%.

CHOOSE DON’T LOSE: You qualify with payment (PITI+) Here are 3 Scenarios.

Credit score 679, 5% down 200k 30 yr fixed loan at 4.75%, taxes of $325 per month, Ins at $70 per month, HOA of $50 per month, PMI at $150 per month. $1043.29 + $325 + $70 + $50 + $150 = $1,638.29

Credit score 720, 5% down 200k 30yr fixed loan at 4.5%, taxes $300 per month, Ins at $60 per month, No HOA, Single PMI. $1,013.37 + $300 + $60 = $1,373.37

That’s a $264 per month savings and that would buy $52,103 more home at the same monthly payment!!

Credit score 720, 5% down 200k 10-1 ARM loan at 3.875%, taxes $300 per month, Ins at $60 per month, No HOA, Single PMI. $940 + $300 + $60 = $1,300.47 If you plan to be in the home 5-7 years a 30 yr amortization with the first 10 yrs fixed adds a greater benefit without additional risk.

That’s a $338 per month savings and that would buy $71,878 more home at the same monthly payment!!

You have choices! For more detailed info please check the Norstar University section of www.PaFhaMortgage.com

By Bill Frantz at Norstar Mortgage